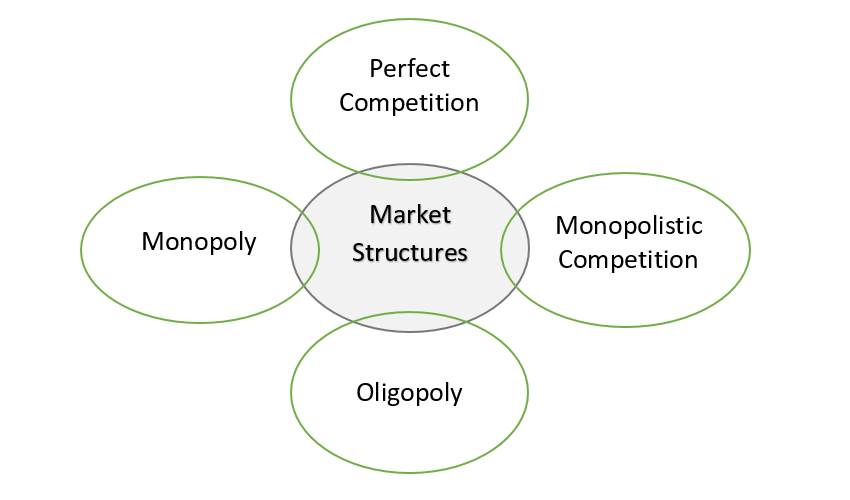

Market structure refers to how a market is setup, its organizational characteristics and the level of competition within the market. Market structure influences pricing, product differentiation, and other market dynamics.

Perfect Competition

In a perfect competition market structure, there are many buyers and sellers. There is no one big seller that dominates the market.

Monopolistic Competition

There are many buyers and sellers. The sellers have differentiated products and may charge marginally higher price since due to their differentiation. Example: Cereals, toothpaste look similar but are slightly differentiated.

Oligopoly

Only a few dominant firms operate in the market. There are many buyers compared to sellers. The sellers use their market power to influence prices and to maximize profits. It is difficult for new firms to enter and establish in such markets.

Monopoly

In a ‘monopoly’ type market structure, there is only one seller that controls the entire market. The company has the power to set any price hence such a structure is undesirable. In a real world scenario, a pure monopoly is very rare.

Consumer Monopoly

In a consumer monopoly, one company dominates the market for a product or service and consumers have very limited or almost no alternatives. In sectors dominated by monopolies, consumers often have no choice but to accept higher prices.

Monopolies often have strong brand recognition and customer loyalty, customers perceive their products as essential or irreplaceable, enabling them to maintain demand even with higher prices. It is also possible that in the absence of competition, monopolistic firms may not have incentives to innovate or improve quality of the product or service.

Monopolies can set prices above competitive levels, and often prevent competition through economies of scale, patents, or regulatory advantages. Due to their dominant market position and pricing power, Monopolies are able to protect themselves against inflation better than other firms by passing costs directly to consumers.

Example: A pharmaceutical company with exclusive rights to life-saving drugs may keep the price significantly high, citing increased manufacturing costs, even though that may not be the case.

Higher prices however may reduce consumer’s purchasing power (especially when inflation is high) and consumers may stay away from buying, especially in industries such as FMCG thus potentially limiting a monopoly’s ability to charge premium prices without significant demand loss.

However, excessive price increases can also lead to regulatory scrutiny and consumer backlash.

Monopolies often secure long-term supplier contracts with fixed prices, they have strong cash reserves and access to low-cost credit, allowing them to face inflationary periods better than smaller firms.

BATheories.com is managed by a group of educators from Mumbai. We also manage the website StudyMumbai.com. Our panel includes experienced professionals and lecturers with a background in management. BATheories is where we talk about the various business theories and models for BA (Business Administration) students.