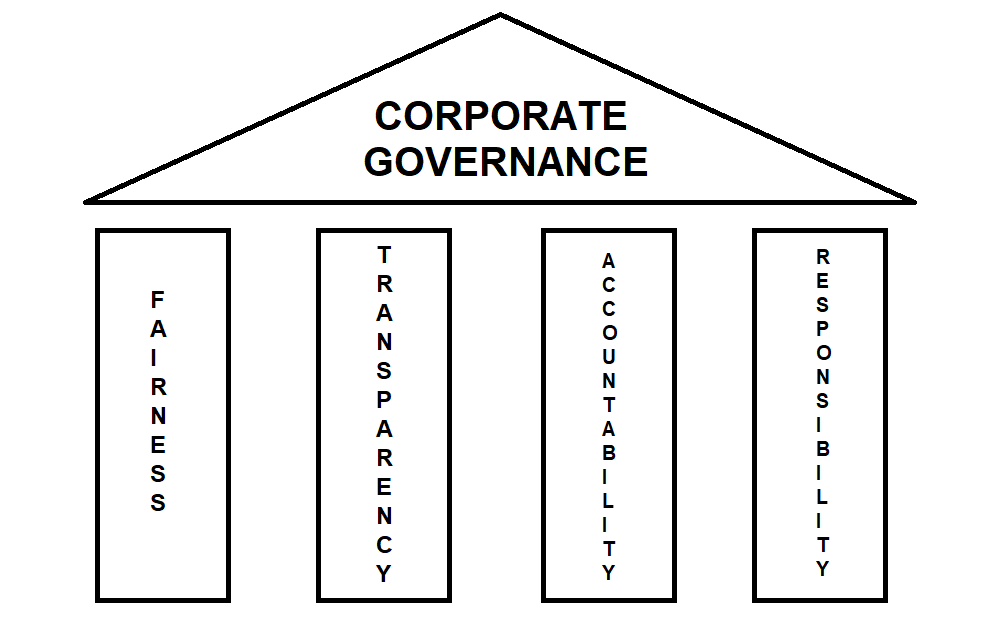

A diverse board can promote transparency, ethical behavior, and responsible decision-making.

The need for better corporate governance is causing an increasing interest in board diversity, and it is now an important issue for managers, directors and shareholders. As a result, more studies are being carried out within corporate governance to understand how board composition influences firm performance.

The responsibilities of boards include contributing towards development of significant strategies and financial decisions, such as mergers and acquisitions, changes in capital structure.

The board of directors is one of the main internal mechanisms of corporate governance which aims at ensuring the interests of shareholders and disciplining the management of firms to maximize the firm value.

Board diversity has become one of the most significant governance issues recently facing managers, directors and shareholders in modern corporations.

Studies related to board diversity tend to link board diversity with different perspectives within the firm, such as corporate strategic change, organizational innovation, corporate governance, and corporate social responsibility.

Board diversity can be defined as the board composition and the varied combination of attributes, characteristics and expertise contributed by individual board members.

There are two fundamental distinctions of previous researches on board diversity: the demographic and the cognitive.

Demographic diversity concentrates on observable factors that can be easily detected, such as age, gender, ethnicity and nationality. It focuses on measurable attributes of individuals. Most researches related to board diversity are mainly focus on observable factors, such as race or ethnic background, age, and nationality.

Cognitive diversity measures attitudinal and normative differences between individuals. It usually refers to non-observable factors such as attitudes, values and beliefs. Cognitive diversity on boards can also be defined in terms of education, occupational backgrounds, and tenure.

The composition of the board of directors influences the way how boards perform, which partially determines the firm’s performance. Therefore, it is possible that board diversities, such as gender, age and ethnicity of the board are related to the firm’s performance.

Theories such as agency theory, resource dependence theory, stakeholder theory, social network theory and social identity theory are usually used to analyze the relationship between board diversity and firm performance.

The independence of boards is critical for the best interests of shareholders. However, the principal-agent modeling is not useful for explaining board-specific phenomena, such as why management seems to have impact on the selection of directors and why the proportion of insiders to outsiders matters.

The Resource Dependency Theory can be applied to board diversity. For example, directors from different backgrounds can provide different beneficial resources to the firm. For instance, directors from different age, gender and nationality can bring diverse perspectives and provide different information to management, resulting in better decision making and generate more alternative solutions to problems. Thus, firms with diverse boards can have more potential and greater abilities to solve problems which can lead to a better firm performance.

Board should care about all stakeholders and not just shareholders.

BATheories.com is managed by a group of educators from Mumbai. We also manage the website StudyMumbai.com. Our panel includes experienced professionals and lecturers with a background in management. BATheories is where we talk about the various business theories and models for BA (Business Administration) students.