Financial statements are important documents that provide a summary of a company’s financial performance and position, it enables stakeholders to evaluate profitability, solvency, liquidity, and overall financial health of the company. The three main types of financial statements are: Balance sheet Income statement Cash flow statement Financial statements are typically prepared and presented to shareholders, […]

Finance & Accounting

Capital Structure & Sources of Funds: Concepts, Theories and Examples

Capital structure refers to the composition of a firm’s capital that is used to fund its operations and growth; it comprises of debt and equity, which may be in different proportions. Businesses need capital to manage their operations and to support growth, and they usually accesses funds through equity finance, debt finance or retained earnings. […]

Internal and External Sources of Finance: Building Blocks of Business Financing

Identify the key external and internal sources of finance, and learn to appraise the potential appropriateness of each of these sources of finance. The investment process involves obtaining funds, evaluating available investment opportunities and making a selection, structuring the terms of the investment, implementing the deal and monitor progress, achieving returns and exiting from the […]

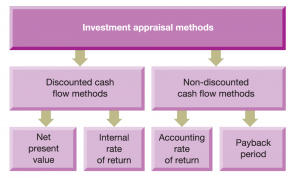

Capital Investment Appraisal Methods

Understand the importance of capital investment planning and appraisal. Learn about the key investment appraisal techniques. Understand the importance of human behaviour issues in investment decision making. Businesses need to make investments and the nature of investment decisions is such that large amounts of resources are often involved and relatively long timescales are involved. It […]

Budgeting 101: How Firms Control Their Finances

Understand the purpose of budgets, learn to interpret information provided in budgets, and learn to critique the benefits and shortcomings of budgets. Why is Budgeting Important So what is the purpose of budgets? We all budget in our personal life, such as for holidays or making a bigger purchase. Businesses also do the same. A […]

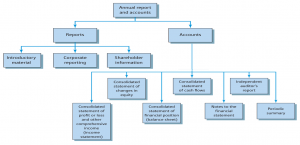

What’s Inside an Annual Report and Why Does It Matter?

Understand the annual report and its key components and why they are more just numbers. Here’s your ultimate guide to company performance metrics. Learn to interpret and analyse the Income Statement and Statement of Financial Position. What is the Annual Report? The annual report is a comprehensive report that provides information on the financial performance […]

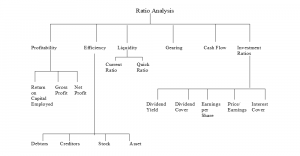

Understanding Financial Ratios: Definitions and Examples

Understand more about financial ratios and what they inform about the business. Learn to calculate and analyse some key financial ratios and draw overall conclusions about a business based on these ratios. “A set of accounts is like a book, which contains the story of a business…but like any good book there is a hidden […]

Cost Accounting 101: Understanding the Basics

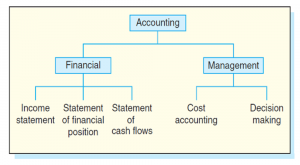

Cost accounting involves summarizing and analyzing all the costs associated with the business activities. This practice also makes it easy to understanding the various costs associated with the business and how those costs impact the business and its profits. Learn more about cost accounting and why its needed in organisations. What is Cost Accounting? Management […]

The Financial Instability Hypothesis

This hypothesis emphasises the accumulation of debt by firms which in times of rising interest rates leads to corporate collapse and hence a fall in output thus compounding the fluctuations in the business cycle. The important intermediary role of the banking sector is also highlighted in the accumulation of debt by firms. The major elements […]

Finance and Accounting for Managers

Finance and Accounting for Managers. Managers need to have enough information about finance/accounting that will help them make good decisions based on financial data, and enable them to evaluate company performance. Here, we will understand the nature and importance of Finance and Accounting, understand the difference between Financial and Management Accounting, understand the limitations of […]