A Goldilocks economy is an ideal economic state where every thing is economic stability. There is optimal growth, low inflation, full employment, balanced saving and spending. In such an economy, there is no risk of high inflation or recession.

In the economic climate, there are three basic conditions: hot, cold and warm. A hot climate makes investors nervous while a cold climate depresses them.

What investors and policy makers ideally desire is a warm climate, also known as the Goldilocks climate.

Most of the time economy moves towards one extreme or another. A Goldilocks economy is not too hot or too cold but just right. The term describes an ideal state for an economic system.

However, it’s hard to maintain Goldilocks’ climate.

In the case of a hot climate, the business booms and people are busy buying goods. It becomes easier to find jobs as jobs are available everywhere. It sounds like a perfect situation as businesses of all kinds make profits and there is surplus money.

However, in the world of finance, hot economy is considered a bad thing, and it worries policy makers as well as investors.

The main worry is that a hot economy and prosperity generally leads to inflation.

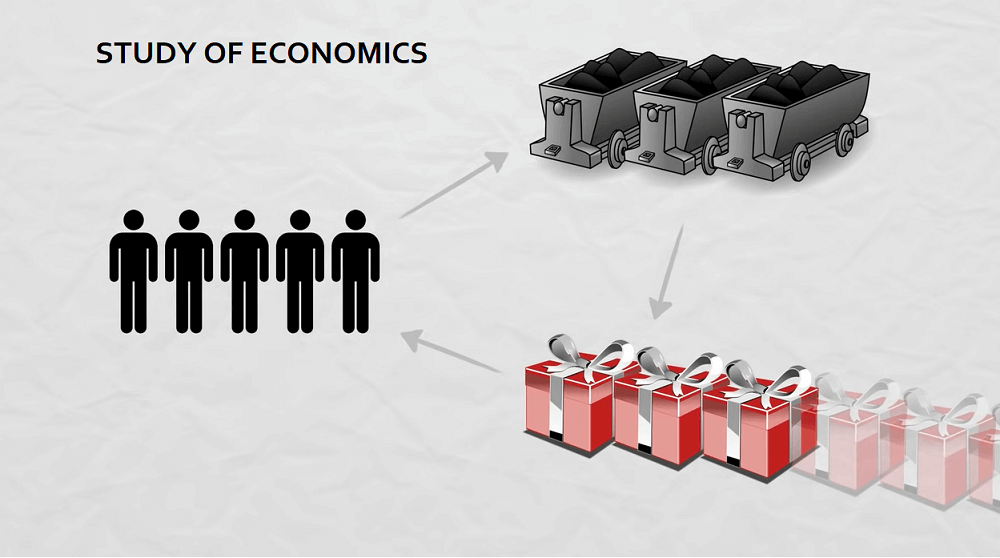

Demand for good and services goes up which leads to a shortage of raw materials and whenever there’s a shortage the prices tends to go up. This has a spiraling effect and very soon the inflation goes out of control.

Soon the banks and the finance companies start charging higher rates of interest on loans further adding to the cost of capital.

A hot economy can’t stay hot forever.

The high cost of money leads to a slump in demand and the prices begin to fall as people start cutting spending which further leads to cutting down production and ultimately it has an effect on jobs too.

And if things get further chillier, it even leads to a recession.

BATheories.com is managed by a group of educators from Mumbai. We also manage the website StudyMumbai.com. Our panel includes experienced professionals and lecturers with a background in management. BATheories is where we talk about the various business theories and models for BA (Business Administration) students.