Managerial Economics (or Business Economics) involves the application of economic theory and decision science tools to solve managerial decision problems, and to examine how an organization can achieve its aims or objectives most efficiently.

Managerial Economics is about applying economic theory and the tools of decision making to examine how a firm can efficiently achieve its aims or objectives related to business functions such as Marketing and Human Resource Management.

Managerial Decision Problems

Managerial decision problems arise in any organization (i.e. non-profit organization such as a hospital or a university or government agency), when they seek to achieve some goal or objective subject to limitations on the availability of essential inputs and in the face of legal constraints.

- Economic Theory: Microeconomics, Macroeconomics

- Decision Sciences: Mathematical Economics, Econometrics

Examples: A hotel may seek to provide guests with adequate service considering its limited physical resources (i.e. rooms, crew, etc.) and budget.

Similarly, a government agency will try to provide a particular service to as many people as possible the lowest feasible cost.

The key to business success or failure is the quality of decision-making by the managers in a business organisation as managerial choices both affect and are affected by, the market environment within which they work.

Managerial decision problems arise in most organisations as managers try to meet their objectives.

- Production Manager must achieve a production target at the lowest possible cost.

- Marketing manager must allocate an advertising budget to promote the product most effectively.

- The chief executive officer (CEO) job is to focus on maximising profit, which requires coordination, and so the CEO or the firm’s top manager must coordinate and direct all the other managers’ activities.

It is widely recognised that the key to business success or failure is the quality of decision-making by the managers in a business organisation.

Managerial economics is an integration of economic theory with business practice for the purpose of facilitating decision making.

- Managers use economic models to consider hypothetical situations—such as “What would happen if we raised our prices by 10%?” or “Would profit rise if we phased out one of our product lines?”

- Models help managers predict answers to what-if questions and to use those answers to make good decisions.

Watch this BBC Report about “Arcadia collapses into administration with 13,000 jobs at risk – BBC News”

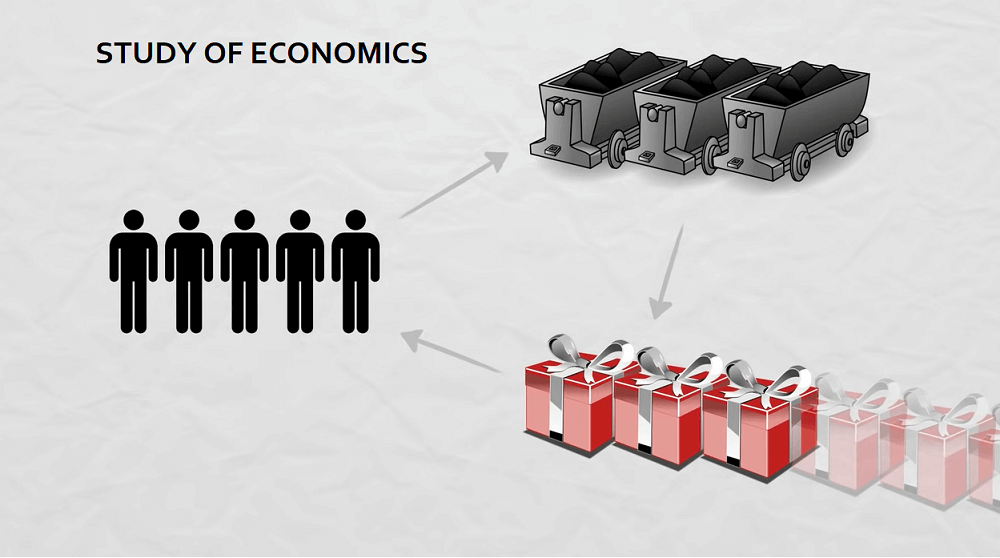

Economic Decision for the firm

Economic concepts help managers come up with answers to important questions in managerial economics, and to use those answers to make good decisions.

Questions that managers must answer:

- What and how much to produce? Should the firm stop producing certain goods/services? Raise or lower the price by how much?

- How are the economic conditions in a particular market? This requires assessing the market structure, changing regulations, supply and demand factors, developments in technology, international issues, macroeconomy. Examples: 2008 banking crisis, Brexit, Coronavirus pandemic.

- Market segmentation decision – which customers to target. Best way to produce, considering staffing, procurement, and capital budgeting.

- How to maintain competitive advantage our competitors through product differentiation, developing niche market, outsourcing, getting into alliances, mergers, and acquisitions?

- What are the risks involved? Should the firm take more risks?

Economic integration of markets

A market is an exchange mechanism that allows buyers to trade with sellers. Markets reduce transaction costs, which is the cost of making a transaction other than the price of the good or service.

Economic integration of markets located in nations around the world provides opportunity to sell more goods & services to foreign buyers. It also presents threat of increased competition from foreign producers

The theory of firm

The theory of firm assumes that the firm seeks to maximize profits and minimize cost. On the basis of that it predicts how much of a particular commodity the firm should produce under different forms of market structure or organization.

Corporate Control Mechanisms

Require managers to hold stipulated amount of firm’s equity. Increase percentage of outsiders serving on board of directors. Finance corporate investments with debt instead of equity

Although the microeconomic theory of firm is the single most important element in the managerial economics, the general macroeconomic conditions of the economy (i.e. the level of aggregate demand, rate of inflation, and interest rate) in which the firm operates are also very important.

Basic Assumptions

Ceteri paribus – is a Latin phrase that means all variables other than the one being studied are assumed to be constant.

Economic Rationality – Economics assume rationality on the parts of its subject like consumer, producer and seller.

It means economic agents see feasible, known and alternative course of action, rank them on priority and choose the one which is highest in ranking order.

Trade-offs and other Decision Makers

Evaluating trade-offs often involves marginal reasoning: considering the effect of a small change. Therefore, when making a business decision, managers analyse the total and marginal benefits and costs of each decision. Decisions should be made using the principle that, for example, investment would proceed if the marginal benefit (MB) exceeded the marginal cost (MC).

For example, Deciding ‘Whether to Innovate’. There are short run and long run profits. Example: Investment in innovation lowers short run profit, but may raise the long run profit.

Other decision-makers

Most interaction and economic decisions are done in markets.

It is important that businesses understand how the decisions made by consumers, managers of other firms, and governments constrain their firm.

- Consumers purchase products subject to their limited budgets. When a manager can set a product’s price, the manager must consider whether raising the price offsets the loss from selling fewer units.

- Rivals may introduce new, superior products or cut the prices of existing products. When competing with rival firms, managers consider using a specific strategy—a plan that specifies the actions or moves that the firm will make to maximize profit. A helpful guide to knowing appropriate strategies tools is understanding the type of market firms operate in.

- Government policies such as taxes, regulations also play an important role in the operation of markets.

Production Possibility Frontier

The production possibility frontier shows the maximum amount of products that can be produced by an economy with the finite resources available.

Opportunity Costs are the benefits forgone from the next best alternative. It is the value of the most valuable of all the options that one has to forego while choosing from a set of options. This is reflected in the downward (negative) slope of the Production Possibility Frontier.

Economic Profit vs. Accounting Profit

Accounting profit is the difference between total monetary revenue and total monetary costs.

Economic profit is the difference between total monetary revenue and total costs, but total costs include both explicit and implicit costs.

Economic profit includes the opportunity costs associated with production and is therefore lower than accounting profit.

Different Types of Economy

Market / Capitalist Economy: In a pure market economy there is no government involvement in economic decisions. The government lets the market answer the following three basic economic questions.

- What? Consumers decide what should be produced in a market economy through the purchases they make.

- How? Production is left entirely up to businesses. Businesses must be competitive in such an economy and produce quality products at lower prices than their competitors.

- For whom? In a market economy, the people who have more money are able to buy more goods and services.

Based on Adam Smith’s invisible hand principle. Examples: USA / European countries.

Command / Socialist Economy – In a command economy the government answers the three basic economic questions.

- What? A dictator or a central planning committee decides what products are needed.

- How? Since the government owns all means of production in a command economy, it decides how goods and services will be produced.

- For whom? The government decides who will get what is produced in a command economy.

Examples: China, and former USSR

Mixed Economy: Private sector is allowed to use free market within the broader political and economic policy framework, public sector reserves certain trade / industry / services / activities

Example : India.

Some Common Mistakes Managers Make

- Never increase output simply to reduce average costs

- Pursuit of market share usually reduces profit

- Focusing on profit margin won’t maximize total profit

- Maximizing total revenue reduces profit

- Cost-plus pricing formulas don’t produce profit-maximizing prices

Nature of the firm

In order to understand the nature of the firm we need to consider 5 main areas of economic theory:

Transaction cost theory, Motivation theory, Agency theory, Information cost theory, Game theory

Transaction Cost Theory

This examines the costs of undertaking transactions in different ways.

These include trading on spot markets, long-term contracts with external parties and internalizing transactions within the firm.

Agency Theory

Principal-agent problem

Conflict that arises when goals of management (agent) do not match goals of owner (principal) . Ex. Shareholders and managers

Motivation Theory

This examines the underlying factors that cause people to behave in certain ways.

In economic terms we are searching for general principles which can be used to explain and predict behaviour.

Information Cost Theory

This examines the concept of bounded rationality, and the associated aspects of incomplete contracting, asymmetric and imperfect information.

These give rise to opportunistic behaviour, which in turn affects the behaviour of other parties and can lead to inefficiencies.

Game theory

This examines the strategic interaction of different agents.

The key to understanding this strategic interaction is that the behaviour of one party affects the behaviour of other parties, and the first party must consider this in determining their own strategy.

BATheories.com is managed by a group of educators from Mumbai. We also manage the website StudyMumbai.com. Our panel includes experienced professionals and lecturers with a background in management. BATheories is where we talk about the various business theories and models for BA (Business Administration) students.