A useful way of gaining insights into competitors and the competitive environment is through industry analysis. Porter’s five forces model is a framework that helps understand the competitive patterns within the industry in which a firm operates.

Introduction

An Industry is “a group of firms that produce products that are close substitutes for each other. Porter (1985) suggested that in order to be an successful player, a firm must understand the competitive patterns in its industry as the pressure from any of these forces can limit its profitability.

Porter’s five forces is a framework that is commonly used to analyse competition in an industry, before a new entrant decides to enter that market (Porter, 2008).

Porter offers his Five Forces model of competition as a means of understanding industry environments and suggests that “competitive generic strategies” are adopted in the light of an environmental analysis to achieve a competitive industry position.

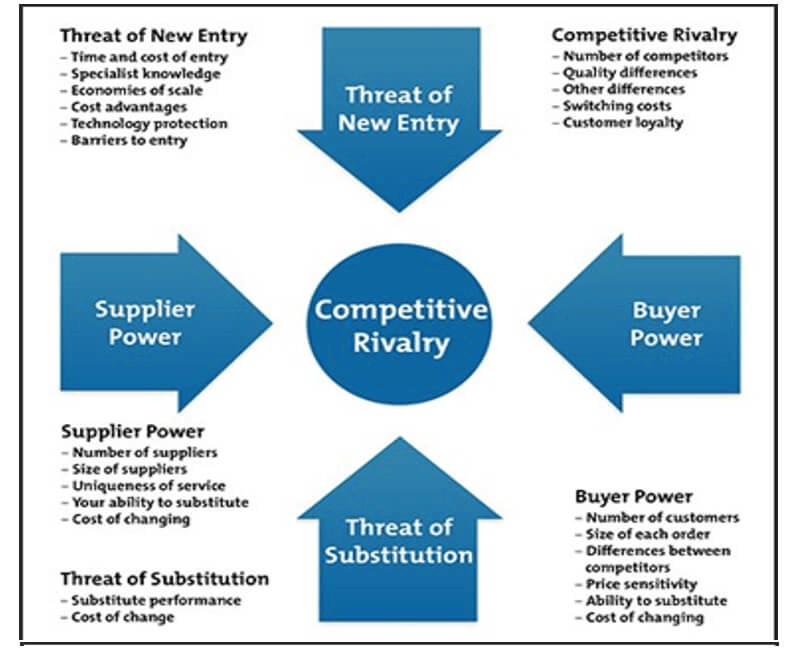

The five forces are:

- Threat on new entrants: How easy is it for a new entrant to enter the market?

- Bargaining power of suppliers: How much power are the suppliers able to influence?

- Bargaining power of buyers: How much power are the buyers able to influence?

- Threat of substitute product: What are the alternatives available to the consumers?

- Existing competition/rivalry: Who are the competitors?

The five forces constitute an industry’s ‘structure’.

While this framework is commonly used by incumbent companies to analyse how competition is shaping up in the market, it can be used by new entrants to understand the various forces, especially the competitors that are in a leading position in the market.

The Five Forces analysis helps the firm to stay competitive by:

- Knowing the strength of these five forces, one can develop strategies that help their businesses be more competitive and profitable.

- Looking at opportunities, one can strengthen their organization’s position compared to the other players for reducing the competitive pressure as well as generate competitive advantage.

- It helps understand which industries/markets to enter or leave

- It helps understand what influence can be exerted?

- The forces may have a different impact on different organisations within the same industry

Porter’s Five Forces

Threat of New Entry

Barriers to entry are the factors that need to be overcome by new entrants if they are to compete. The threat of entry is low when the barriers to entry are high and vice versa.

When the barriers to entry into an industry are high, new businesses can hardly enter the market due to high costs and strong competition. Some Industries can claim a competitive advantage because their products are not homogeneous, and they can sustain a favorable position.

The main barriers to entry are:

- Economies of scale/Experience/Network effects.

- Access to supply and distribution channels.

- Differentiation and market penetration costs.

- Legislation or government restrictions (e.g. licensing).

- Expected retaliation.

- Incumbency advantages.

- Brand loyalty.

- Intellectual property like patents, licenses, etc.

- Access to raw materials is controlled by existing players.

- Legislation and Government Acts.

Competitive Rivalry

Competitive rivals are organisations with similar products and services aimed at the same customer group and are direct competitors in the same industry/market (distinct from substitutes).

The degree of rivalry depends on: Competitor concentration and balance, Industry growth rate, High fixed costs, High exit barriers, Low differentiation.

In highly competitive industries, firms can exercise little or no control on the prices of the goods and services. However, when the industry enjoys monopoly, businesses can fully control the prices of goods and services.

Rivalry between existing players is likely to be high when:

- Players are the same size.

- Players have comparable strategies.

- Little or no differentiation between players and their products leading to price competition.

- Low market growth rates.

Market share is one indicator of competitive standing in a market. It is defined as the percentage of sales within a market that is accounted for by a company, brand or product; calculated in units or money (or both).

Threat of Substitution

Substitutes are products or services that offer a similar benefit to an industry’s products or services, but have a different nature i.e. they are from outside the industry.

Where close substitute products exist in a market, it increases the likelihood of customers switching to alternatives in response to price increases. However, when a business follows a product differentiation strategy, it can determine the ability of buyers to switch to the competition.

This threat is determined by things such as:

- Brand dependability of customers.

- Secure customer relationships.

- Switching costs for customers.

- The relative price for performance of substitutes.

Customers will switch to alternatives (and thus the threat increases) if:

- The price/performance ratio of the substitute is superior (e.g. aluminium is more expensive than steel but it is more cost efficient for car parts)

- The substitute benefits from an innovation that improves customer satisfaction (e.g. high speed trains can be quicker than airlines from city centre to city centre on short haul routes).

- Extra-industry effects. Substitutes come from outside the incumbents’ industry which forces managers to look outside their own industry to consider more distant threats and constraints.

Supplier Power

Suppliers are those who supply what organisations need to produce the product or service. Powerful suppliers can reduce an organisation’s profits.

Supplier power represents the extent to which the suppliers can influence the prices. When there are a lot of suppliers, buyers can easily switch to competitors because no supplier can, actually, influence the prices and exercise control in the industry.

Supplier bargaining power is high when:

- The suppliers are concentrated (few of them). The market is conquered by a few big suppliers.

- Suppliers provide a specialist or rare input. Uniqueness of their product or service

- The supplier customer base is fragmented, making their bargaining power low.

- High switching costs from one to another supplier (it is disruptive or expensive to change suppliers).

- Suppliers can integrate forwards (e.g. low-cost airlines have cut out the use of travel agents).

Buyer Power

Buyers are the organisation’s immediate customers, not necessarily the ultimate consumers. If buyers are powerful, then they can demand cheap prices or product/service improvements to reduce profits.

The bargaining power of customers looks at customers’ ability to affect the pricing and quality of products and services. When the number of consumers of a particular product or service is low, they have much more power to affect pricing and quality. The same holds true when a large proportion of buyers can easily switch to a different product or service.

Customer bargaining power (buyer power) is high when:

- Buyers are concentrated

- Switching products is easy, simple and does not incur high costs.

- Customers procure large volumes.

- The supplying industry consists of several small operators.

- Buyers can supply their own inputs (backward vertical integration)

- The product has substitutes.

- Low buyer profits (under pressure to improve profits) and the purchased inputs have a low impact on quality (can cut costs without loss of quality).

Complementors

Some experts argue that complementors should be the “sixth force” in this kind of analysis.

Demand complementors: An organisation is your complementor if it enhances your business attractiveness to customers. (E.g. app suppliers are complementors to smartphone producers).

Supply complementors: An organisation is a complementor with respect to suppliers if it is more attractive for a supplier to deliver when it also supplies the other organisation. (E.g. a competing airline can be a complementor with respect to a supplier like Boeing – as Boeing may invest more in improvements if they are supplying both airlines).

Implications of Five Forces Analysis

Which industries/markets to enter or leave? – it helps identify the attractiveness of industries.

What influence can be exerted? Identifies strategies that can influence the impact of the five forces. E.g. building barriers to entry by becoming more vertically integrated.

The forces may have a different impact on different organisations. E.g. large firms can deal with barriers to entry more easily than small firms.

Issues in Five Forces Analysis

Defining the ‘right’ industry. Applying the model at the most appropriate level – not necessarily the whole industry. E.g. the European low-cost airline industry rather than airlines globally.

Converging industries – particularly in the high tech arenas – where industries overlap (e.g. digital industries – mobile phones/cameras/mp3 players).

Complementary organisations – which enhance the attractiveness of a business to customers or suppliers. Microsoft Windows and McAfee computer security systems are complementors. This can almost be considered as a sixth force.

References

Porter, M.E. (2008) The Five Competitive Forces that Shape Strategy. Harvard Business Review, 86, 79-93.

BATheories.com is managed by a group of educators from Mumbai. We also manage the website StudyMumbai.com. Our panel includes experienced professionals and lecturers with a background in management. BATheories is where we talk about the various business theories and models for BA (Business Administration) students.