Stability of the Market Economy

Classical/Neoclassical View

The economy is inherently stable. Any instability is a temporary phenomenon as the market (forces of demand and supply) has strong self-correcting tendencies which make it stable. For example, this is highlighted by:

The market for loanable funds

The important characteristics of this market are:

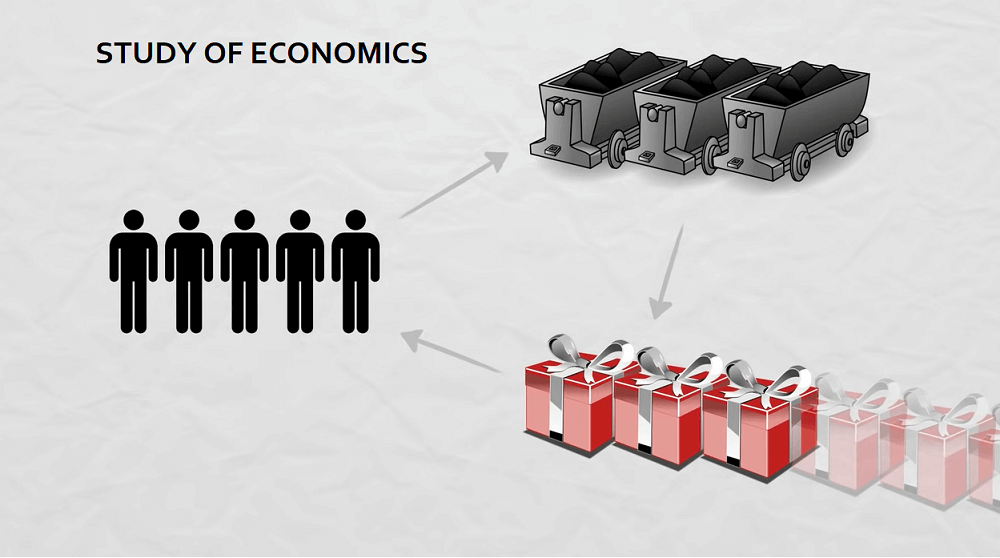

- The economy’s output is distributed to consumers in the form of wages and firms in the form of profits.

- However, consumers save (S) a portion of their wages (income) which constitutes a leakage of liquidity (money) from the circular flow (economy) thereby reducing effective demand and in particular consumption expenditure on goods and services) and hence slowing output.

- Firms use a large portion of their profits to undertake investment expenditure (I) which is an injection of liquidity into the circular flow (economy) that increases effective demand ( in particular investment expenditure) and hence output. It is assumed that the leakage (S) exactly offsets the injection (I) so that: S=I

This indicates there is no change in liquidity in the economy and hence effective demand that leads to (GDP) neither expanding nor contracting thereby growing at the same rate.

This condition, i.e. S=I also indicates the market for loanable funds is in equilibrium.

If S˃I the leakage exceeds the injection which leads to a contraction of the circular flow (amount of liquidity in the economy) and hence effective demand. The loanable funds market responds to the lower effective demand by reducing the interest rate which:

- Discourage S.

- And encourages I

thereby restoring equilibrating in the market for loanable funds.

When S˂I or I˃S the reverse analysis applies.

Thus, any disequilibrium is a temporary phenomenon as the market is sufficiently flexible to restore equilibrium.

The Labour Market

This market is normally in equilibrium i.e. supply =demand for labour. Any disequilibrium is a temporary phenomenon. For example, at the real wage rate above equilibrium, supply ˃ demand for labour→↑ unemployment→↓ in the real wage rate which ↑demand and ↓ supply of labour. This eventually restores equilibrium. If the real wage rate is below equilibrium, the reverse analysis prevails.

The classical / neoclassical schools emphasise that not only are the loanable funds and labour markets in equilibrium but all other markets (such as the market for goods and services and government bond markets) thereby making the economy stable.

The stability of the market economy is also highlighted by the:

Quantity Theory of Money

This theory (also known as the equation of exchange) is expressed as: M*V=P*Q

- M*=the rate of growth of the money supply.

- V= the velocity of circulation of money (is assumed to be fixed).

- P*= the price level

- P*Q = Nominal GDP.

- Q=full employment output level i.e. where the economy fully utilises productive capacity and hence resources. Q is assumed to be constant which means the economy is always at the full employment output level.

Therefore, an increase in M* will be reflected in a proportionate increase in P* (as the economy is fully utilising its productive capacity and hence resources). Thus, there is no change in the level of output (Q) but only a change in the inflation rate and hence nominal GDP. Thus, the underlying condition of the economy is that GDP is stable.

J.M Keynes and the Instability of the Market Economy

The Great Depression of the 1930s was characterised by large losses in GDP and hence employment. This made J.M. Keynes realise the economy did not have self-correcting tendencies thereby making it unstable i.e. output and employment fluctuate. Instability is therefore the norm for market economies. According to Keynes:

a. Y=C+ Ii +G+NX

Specifically, the value of output (Y) is approximated by the value of aggregate expenditure (demand). However, output is unstable principally because Ii (intended investment) is unstable. Investment is defined as:

- Expenditure by firms on equipment (or machinery)

- Expenditure by firms on structures (factories)

- Expenditure by firms on inventories.

b. What Explains the Instability of Investment? The MEC and Expected Rate of Interest.

Expenditure on equipment and structures constitutes productive investment. Expenditure on productive investment is undertaken by firms on the basis of the expected rate of return for each project. Firms rank the expected rate of return of projects from the highest to lowest. This procedure is known as the Marginal Efficiency of Capital (MEC).

The MEC is compared to the expected rate of interest (r)which constitutes the cost of borrowing. Ultimately, investment projects are undertaken when:

MEC˃ r

However, the ranking of investment projects on the basis of the MEC (or expected rate of return) changes continuously in light of new information. This makes investment expenditure volatile and hence unstable.

This volatility is compounded due to the continued fluctuation of the expected rate of interest which is due to instability in the money market. In particular, the demand for money is unstable in the money market. The demand for money constitutes:

- Demand for money for transaction purposes

- Demand for money for precautionary purposes

- Demand for money for speculative purposes

The demand for money for speculative purposes is the unstable element of the demand for money due to changes in the demand for money to make a capital gain or avoid a capital loss on (government) bonds. Specifically,

- The expected capital gain on bonds will increase the demand for money for speculative purposes to buy government bonds.

- The expectation of a capital loss on government bonds will decrease the demand for money for speculative purposes in order to avoid a capital loss.

- Expectations of capital gains or losses with bonds change continuously in light of new information thereby leading to fluctuations in the demand for money for speculative purposes and hence the overall demand for money.

Thus, demand for money is therefore unstable as reflected by the demand for money schedule constantly shifting to the left or right in the money market.

The continuous shift of the demand for money schedule within the context of a stable (and vertical) money supply schedule leads to constant fluctuations in the rate of interest (the vertical money supply curve is exogenous because it reflects the money supply in the economy is under the control of the central bank). This creates expectations of continuous changes in the rate of interest.

Thus both:

- The MEC

- Expected rate of interest

change continuously thereby making investment expenditure volatile and hence unstable.

A secondary and relative less significant explanation of the instability of investment expenditure is due to unintended investment in inventories by firms. Specifically,

I= Ii + Iu

Where

- I = Actual investment

- Ii = Intended (or planned) investment in equipment and structures.

- Iu= Unintended (or unplanned) investment in inventory

When AE (aggregate expenditure) =Y (output) then equilibrium output in the economy occurs that means there is no change in investment in inventories.

Thus, if AE˃Y this constitutes excess demand for goods and services → a shortage of goods and services → a rundown in inventories and hence ↓ unintended investment in inventories → ↓ actual investment expenditure.

If AE˂Y this constitutes weak demand for goods and services → a surplus of goods and services → an ↑ in inventories and hence in unintended investment in inventories → ↑ actual investment expenditure.

Since the economy is unstable according to Keynes, AE˃Y or AE˂Y will be the normal state of affairs thereby leading to continuous ↓ or ↑ in unintended investment in inventories and hence total investment expenditure which in turn constitute volatility in this variable.

It is important to highlight that the instability of investment will lead to amplified fluctuations in AD and hence output due to the operation of the multiplier (the multiplier is also associated with a change in G and X).

Specifically:

∆ Y=∆ I*1/S

Where Y = income, I = Investment expenditure, 1/S= the multiplier, S = The marginal propensity to save

For example, assume I ↑ by $50m and S=0.5. The ∆Y is calculated as follows:

∆Y= $50m * 1/0.5, ∆Y=$50* 2, ∆Y=$100m

BATheories.com is managed by a group of educators from Mumbai. We also manage the website StudyMumbai.com. Our panel includes experienced professionals and lecturers with a background in management. BATheories is where we talk about the various business theories and models for BA (Business Administration) students.